With Bank Feeds How to Remove Transactions That Dont Need Wifi

As we must all be aware that QuickBooks has a bank feed feature that is used to import the back transactions from the bank account and these transactions are then reflected under the bank feed section in QuickBooks. Know steps to delete a bank transaction uploaded from a bank account.

This feature is really very helpful as it eliminates the requirement of manually recording each and every bank transaction that can require a lot of manual effort and can lead to many errors as well.

Save Time, Reduce Errors, and Improve Accuracy

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

But sometimes as it happens, due to one reason or other, the transactions appearing in your bank feed section are not reflecting the true picture that should be there in the book of accounts, in that case, you may want to delete a bank transaction or multiple transactions in a one go.

For example, you imported your bank transactions in the bank feed section but took the incorrect range of dates, which resulted in duplicate transactions in the bank feed section, i.e., the transactions that have been taken to ledgers are appearing again.

These sorts of cases can be solved by excluding the transaction feature, which will help you transfer your transactions to excluded status, after which you can select to delete the entire batch of transactions uploaded from the bank website and start again. Both of these process steps will be discussed in this article, we will look into their step-wise step execution in the below sections.

Steps to Deleting a Bank Transaction Uploaded from the Bank Account

First of all, for deleting a transaction, you need to exclude it from the system, for this you will have to follow the below steps:

Step 1. Open QuickBooks and go to the banking tab by selecting the banking menu.

Step 2. In the second step, go to the review tab, you will have to scroll down to select for the review tab.

Step 3. Now click on the checkboxes against the transactions that you wish to exclude.

Step 4. Now go to the drop-down action column and click Batch actions and choose "Exclude selected".

Step 5. Now the transactions that you have excluded will be transferred to the "Excluded tab", where you can go ahead and delete it.

Process Steps for Deleting the Entire Batch of Transactions

For deleting the entire batch of uploaded transactions, you should follow the below steps:

Step 1. Once you have followed the process of transferring the transactions in the "Excluded tab". Go to the Excluded tab.

Step 2. Now click mark the transactions that you wish to delete.

Step 3. Now go to the drop-down menu for batch action and click on delete.

Step 4. In this step, you will get a prompt that would say 'Are you sure? these transactions will not be recoverable. You need to click on "Yes" to confirm this action.

Your uploaded bank transactions will be deleted permanently after this step. Hope these process steps help you out in deleting the transactions from QuickBooks in a seamless and hassle-free manner. But we will also look into some collated frequently asked questions from the users end, this will give you an insight into the additional queries that might arise when you are executing the process steps. These questions may also include some related topics, which you can refer to as a cheat sheet.

Accounting Professionals, CPA, Enterprises, Owners

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-347-428-6831 or chat with experts.

Frequently Asked Questions (Faqs)

What are the Steps for Deleting a Transaction in QuickBooks Online?

First, click open the QuickBooks online in your browser and log in with your credentials. Then you need to find the transaction that you want to delete from the search icon and click on more from the footer. Now select delete and click Yes to confirm.

Can You List Down the Steps to Delete an unreconciled Transaction in QuickBooks?

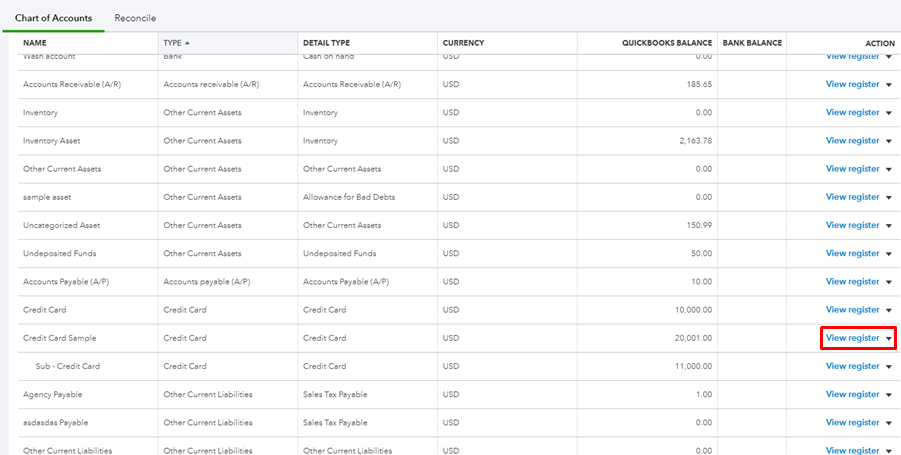

Yes, for this first you need to go to the Accounting tab and then click on Chart of Accounts, now you need to find your cash sales account and click on view register under the Action column. Now locate and click to edit the transaction and go ahead the 'R' from the checkbox against the transaction and click on save and close.

Is there Any Way to Delete a Payment in QuickBooks?

Yes, surely there is, for this you need to go to the Lists menu > choose chart of Accounts and double-click undeposited funds to open register. Now click the deposit you wish to delete from the register and go to the edit menu to delete the payment.

How Can I Delete the Payment from Undeposited Funds in QuickBooks?

You need to first click open your QuickBooks account and log in by entering your credentials. Now go to the lists > Chart of Accounts and then undeposited funds. Then go to amounts and right-click on amount and click on delete.

How Can I Delete old Years Entries in QuickBooks?

Click open the Accounting tab from the left menu and go to the Chart of Account tab, search for credit card account and click view register. Now click the payment that you created and choose to edit. After that, at the bottom of the expense or check window click on more and finally select delete and yes to confirm the action.

Why my Bank Balance is not Matching with QuickBooks Balance, is there any way to fix this?

The bank balance and QuickBooks balance do not match with each other usually due to some manually created transactions. For reconciling the two, you need to compare the list of transactions on your bank statement from the transactions appearing in QuickBooks. Once you find the difference, you can go ahead and reconcile the transactions manually in QuickBooks Online.

What is Cleared Balance Transactions and How Can I make them so?

A cleared transaction is the one that has hit your credit card or bank account but has not been yet reconciled in QuickBooks reconciliation cycle. You can manually mark the transaction as cleared in QuickBooks.

Features of Dancing Numbers for QuickBooks Desktop

Imports

Exports

Deletes

Customization

Supported Entities/Lists

Dancing Numbers supports all QuickBooks entities that are mentioned below:-

Customer Transactions

| Invoice |

| Receive Payment |

| Estimate |

| Credit Memo/Return Receipt |

| Sales Receipt |

| Sales Order |

| Statement Charge |

Vendor Transactions

| Bill |

| Bill Payment |

| Purchase Order |

| Item Receipt |

| Vendor Credit |

Banking Transactions

| Check |

| Journal Entry |

| Deposit |

| Transfer Funds |

| Bank Statement |

| Credit Card Statement |

| Credit Card Charge |

| Credit Card Credit |

Employee Transaction / List

| Time Tracking |

| Employee Payroll |

| Wage Items |

Others

| Inventory Adjustment |

| Inventory Transfer |

| Vehicle Mileage |

Technical Details

Easy Process

Bulk import, export, and deletion can be performed with simply one-click. A simplified process ensures that you will be able to focus on the core work.

Error Free

Worried about losing time with an error prone software? Our error free add-on enables you to focus on your work and boost productivity.

On-time Support

We provide round the clock technical assistance with an assurance of resolving any issues within minimum turnaround time.

Pricing

Importer, Exporter & Deleter

*See our Pricing for up to 3 Company Files

$199/- Per Year

Pricing includes coverage for users

- Services Include:

- Unlimited Export

- Unlimited Import

- Unlimited Delete

Accountant Basic

*See our Pricing for up to 10 Company Files.

$499/- Per Year

Pricing includes coverage for users

- Services Include:

- Importer,Exporter,Deleter

- Unlimited Users

- Unlimited Records

- Upto 10 companies

Accountant Pro

*See our Pricing for up to 20 Company Files.

$899/- Per Year

Pricing includes coverage for users

- Services Include:

- Importer, Exporter, Deleter

- Unlimited Users

- Unlimited Records

- Up to 20 companies

Accountant Premium

*See our Pricing for up to 50 Company Files.

$1999/- Per Year

Pricing includes coverage for users

- Services Include:

- Importer, Exporter, Deleter

- Unlimited Users

- Unlimited Records

- Up to 50 companies

Dancing Numbers: Case Study

Frequently Asked Questions

How and What all can I Export in Dancing Numbers?

You need to click "Start" to Export data From QuickBooks Desktop using Dancing Numbers, and In the export process, you need to select the type you want to export, like lists, transactions, etc. After that, apply the filters, select the fields, and then do the export.

You can export a Chart of Accounts, Customers, Items, and all the available transactions from QuickBooks Desktop.

How can I Import in Dancing Numbers?

To use the service, you have to open both the software QuickBooks and Dancing Numbers on your system. To import the data, you have to update the Dancing Numbers file and then map the fields and import it.

How can I Delete in Dancing Numbers?

In the Delete process, select the file, lists, or transactions you want to delete, then apply the filters on the file and then click on the Delete option.

How can I import Credit Card charges into QuickBooks Desktop?

First of all, Click the Import (Start) available on the Home Screen. For selecting the file, click on "select your file," Alternatively, you can also click "Browse file" to browse and choose the desired file. You can also click on the "View sample file" to go to the Dancing Numbers sample file. Then, set up the mapping of the file column related to QuickBooks fields. To review your file data on the preview screen, just click on "next," which shows your file data.

Which file types are supported by Dancing Numbers?

XLS, XLXS, etc., are supported file formats by Dancing Numbers.

What is the pricing range of the Dancing Numbers subscription Plan?

Dancing Numbers offers four varieties of plans. The most popular one is the basic plan and the Accountant basic, the Accountant pro, and Accountant Premium.

How can I contact the customer service of Dancing Numbers if any issue arises after purchasing?

We provide you support through different channels (Email/Chat/Phone) for your issues, doubts, and queries. We are always available to resolve your issues related to Sales, Technical Queries/Issues, and ON boarding questions in real-time. You can even get the benefits of anytime availability of Premium support for all your issues.

How can I Import Price Level List into QuickBooks Desktop through Dancing Numbers?

First, click the import button on the Home Screen. Then click "Select your file" from your system. Next, set up the mapping of the file column related to the QuickBooks field. Dancing Numbers template file does this automatically; you just need to download the Dancing Number Template file.

To review your file data on the preview screen, just click on "next," which shows your file data.

What are some of the features of Dancing Numbers to be used for QuickBooks Desktop?

Dancing Numbers is SaaS-based software that is easy to integrate with any QuickBooks account. With the help of this software, you can import, export, as well as erase lists and transactions from the Company files. Also, you can simplify and automate the process using Dancing Numbers which will help in saving time and increasing efficiency and productivity. Just fill in the data in the relevant fields and apply the appropriate features and it's done.

Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business. It is free from any human errors, works automatically, and has a brilliant user-friendly interface and a lot more.

Why should do you change the Employee status instead of deleting them on QuickBooks?

If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this mostly implies that they have some history. Thus, if you change the employee status instead of deleting it on QuickBooks, the profile and pay records remain in your accounting database without any data loss in your tax payments.

Is it possible to use the Direct Connect option to sync bank transactions and other such details between Bank of America and QuickBooks?

Yes, absolutely. You can use the Direct Connect Option by enrolling for the Direct Connect service which will allow you access to the small business online banking option at bankofamerica.com. This feature allows you to share bills, payments, information, and much more.

Why should do you change the Employee status instead of deleting them on QuickBooks?

If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this mostly implies that they have some history. Thus, if you change the employee status instead of deleting it on QuickBooks, the profile and pay records remain in your accounting database without any data loss in your tax payments.

What are the various kinds of accounts you could access in QuickBooks?

QuickBooks allows you to access almost all types of accounts, including but not limited to savings account, checking account, credit card accounts, and money market accounts.

Get Support

Bulk import, export, and deletion can be performed with simply one-click. A simplified process ensures that you will be able to focus on the core work.

Worried about losing time with an error prone software? Our error free add-on enables you to focus on your work and boost productivity.

Source: https://www.dancingnumbers.com/delete-a-bank-transaction-uploaded-from-a-bank-account/

0 Response to "With Bank Feeds How to Remove Transactions That Dont Need Wifi"

Post a Comment